Finding Attractive Yields and Low Duration in Investment Grade Credit

The following article was published in Money Management on 1 October 2021.

In today’s market environment, investors are faced with the challenge of seeking attractive current income without reaching for risk. To solve for this, we seek to unearth investment solutions offering higher yields and diversification for Australian investors’ portfolios within the more senior, higher quality segments of the corporate debt and alternative credit markets.

In this article, we examine the attractive attributes of an allocation to liquid alternative credit; specifically, why we believe collaterised loan obligations (CLOs) investing offers a compelling investment grade opportunity and how a dynamic, flexible approach can capture value across various market environments.

Liquid Alternative Credit

Investment grade credit is not limited to traditional corporate bonds, as liquid alternative credit also offers products rated triple-B or higher, including CLOs and real estate debt securities. As many investors struggle to find attractive income solutions in today’s market environment, we believe certain liquid alternative credit asset classes, specifically CLO debt securities, screen attractively as they offer a yield premium relative to similarly rated corporate debt. As of

30 June, 2021, that premium was 200bps for triple-B rated debt.

In addition to attractive yields, CLOs offer protection against both rising interest rates and inflation due to their low duration of less than one year. From a credit risk perspective, CLOs also have various structural enhancements that substantially reduce the chances of default within their debt tranches.

We believe the CLO debt market presents opportunities to capture value arising from a high degree of pricing inefficiency as these instruments are generally misunderstood by the broader market and may often reflect a perceived complexity or illiquidity premium.

CLOs are much like a managed fund in the sense that they directly invest in a portfolio of broadly syndicated bank loans selected and are actively managed by a CLO manager. The portfolio of bank loans is subject to investment guidelines, including industry concentrations and ratings limitations, further diversifying the investment.

Investors hold securities that are issued such that one may invest in a particular tranche, usually issued with varying maturities, credit ratings, and yields, based on investor appetite from a risk/return perspective. Having the capabilities to analyse the underlying pool of assets, the structure, and the manager of CLO securities is therefore paramount to investing in the asset class.

Typically, these more esoteric asset classes have barriers to entry as they require:

- Technical expertise;

- An established investment platform to access and unlock the benefits associated with alternative credit markets; and

- A rigorous, cycle-tested risk management approach.

In short, we believe that managers with the right skills and infrastructure can unlock for investors liquid alternative credit’s compelling investment-grade opportunity defined by current yield, downside protection and value creation from market inefficiencies.

Dynamic Allocation Approach

We also believe a dynamic portfolio allocation spanning investment grade corporate credit and liquid alternative credit is paramount as, beyond the diversification benefits, it also offers additional opportunity to generate alpha. This can be done by shifting targeted exposures through active portfolio management as value shifts between markets can generate attractive entry points into each asset class.

When the COVID-19 induced market turmoil gathered pace in March 2020, the Federal Reserve took quick and decisive action to cut the federal-funds rate to nearly zero and maintained its dovish stance throughout 2020.

Investment grade corporate bonds, which predominately have fixed payment schedules and are subject to significant levels of interest rate risk, subsequently benefitted from falling interest rates alongside other longer duration-oriented strategies. From a historical perspective, the base rate return component has attributed to 84% of investment grade bond total returns since January 1999. As broader risk assets continued to rally throughout the year, triple-B rated loans and CLOs outperformed in the latter part of 2020.

Specific to the Ares Global Credit Income fund, we repositioned the portfolio throughout 2020 as market conditions evolved. At the fund’s inception in May 2020, we initially deployed the portfolio’s investment grade allocation in single-A rated CLO debt securities and triple-B rated bonds given the potential for spread tightening amid improving technicals within these segments of the credit market.

As broader risk assets continued to rally throughout the year, we took profits on our triple-B rated corporate bond exposure and rotated into triple-B rated CLO debt securities as the asset class presented a stronger relative value opportunity. Additionally, within the portfolio’s CLO debt allocation, we dynamically allocated between newer vintages (primary) and seasoned securities sourced in the secondary markets to add attractive risk adjusted returns.

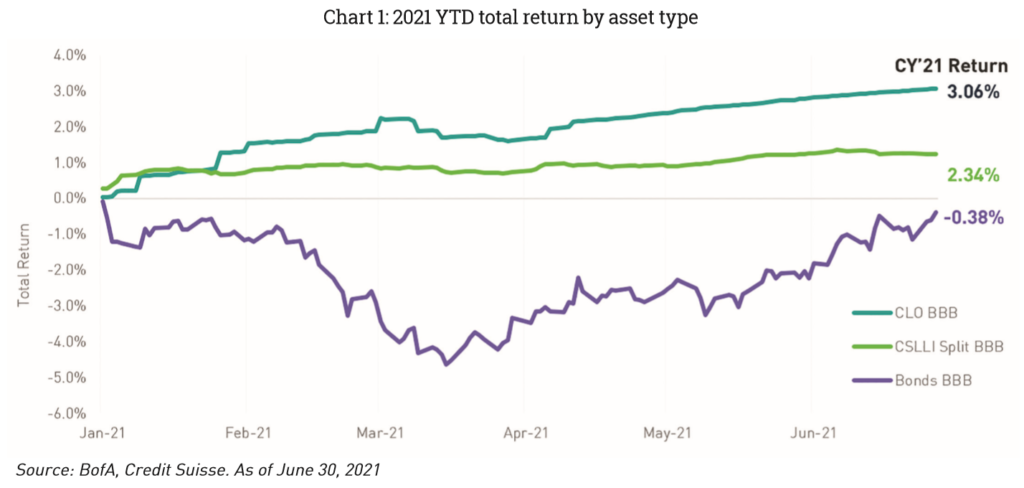

In contrast to 2020, investment grade corporate credit has lagged the broader market rally during the first half of 2021, posting negative returns for the first half of the calendar year. This was due to the re-opening of the global economy, concerns around inflation and a material move higher in interest rates drove investor demand for higher beta, floating rate instruments.

Meanwhile, triple-B rated loans proved resilient to inflationary pressures and outperformed similarly rated corporate bonds due to their floating rate, low duration profile.

Similar to loans, triple-B rated CLO debt securities have also benefitted from a shifting rate environment in 2021 as robust demand for lower duration assets, strong technicals, and a yield premium of 100 to 200 basis points (bps) relative to similarly-rated corporate debt provided a supportive tailwind to the asset class.

As demonstrated above, we believe the CLO debt market presents opportunities to capture value arising from a high degree of pricing inefficiency as these instruments are generally misunderstood by the broader market and may often reflect a perceived complexity or illiquidity premium.

In summary, we believe CLO investing offers a compelling risk-adjusted return opportunity for investment grade allocations.

Teiki Benveniste is head of Ares Australia Management.

To read the full version, download the PDF

Fidante Partners Limited ABN 94 002 835 592 AFSL 234668 (Fidante), a member of the Challenger Limited group of companies (Challenger Group), has entered into arrangements with Ares and Ares Australia Management Pty Ltd ABN 51 636 490 732 (AAM), in connection with the distribution and administration of financial products managed by Ares or AAM. In connection with those arrangements, Fidante or AAM may receive remuneration or other benefits. Neither Fidante nor AAM nor any of their associates are responsible for the information in this material, including any statements of opinion and accept no liability whatsoever in relation to it. AAM is an Authorised Representative No. 001280423 of Fidante and is in the process of seeking its own Australian Financial Services Licence.

Ares is exempt from the requirement to hold an Australian Financial Services Licence. Ares is subject to regulation by the Securities & Exchange Commission of the United States of America under US laws, which differ from Australian laws. This publication is only made available to ‘wholesale clients’ or ‘sophisticated investors’ under the Corporations Act 2001 (Cth) in Australia.

Fidante is not an authorised deposit-taking institution (ADI) for the purpose of the Banking Act 1959 (Cth), and its obligations do not represent deposits or liabilities of an ADI in the Challenger Group (Challenger ADI) and no Challenger ADI provides a guarantee or otherwise provides assurance in respect of the obligations of Fidante. Investments in the Fund(s) are subject to investment risk, including possible delays in repayment and loss of income or principal invested. Accordingly, the performance, the repayment of capital or any particular rate of return on your investments are not guaranteed by any member of the Challenger Group.